“A customer interview is not a discussion.” – Étienne Garbugli

The solution or customer interview phase is another opportunity to deepen your relationship with early adopters.

With sometimes as little as 30 minutes per meeting, you want to spend the bulk of your time exploring the solution (your product) and testing the pricing model.

Since you know their pain, meetings with prospects that you already met will be more straightforward, while meetings with new prospects will be more exploratory.

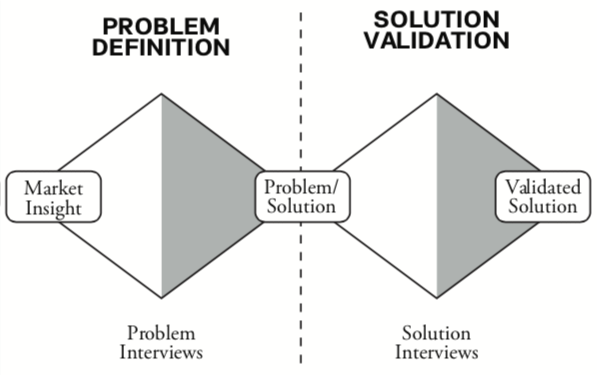

To maximize learning opportunities, solution interviews should follow a structure similar to that of problem interviews:

- Greetings (two minutes): Small talk to deepen the relationship and make the prospect feel comfortable.

- Problem qualification (three minutes): Validate that the pain that your solution removes is a pain they have or have visibility on.

- Telling a compelling story (five minutes): Explain what was learned on the industry, your approach and what makes your solution unique.

- Solution exploration and demo (15 minutes): Show your solution Minimum Viable Product (MVP) and evaluate the match with the expectations and the value sought.

- Closing (five minutes): Share the pricing and close the prospect on a pilot or another meeting.

You have to learn and adapt with every pitch until you find a model that works and that clicks with your prospects.

The key here is to try and close the prospect on another customer interview, a pilot project or a sale if the purchase makes sense for all parties. Don’t waste anyone’s time if you’re not ready to close.

More on the Customer Interview

- How to Structure Customer Development Interviews to Get Valuable Insights

- How to Make the Most of Your B2B Customer Discovery Problem Interviews

Download the First 4 Chapters Free

Learn the major differences between B2B and B2C customer development, how to think about business ideas, and how to assess a venture’s risk in this 70-page sampler.

Working on a B2B Startup?

Learn B2B customer development with our free email course: