Your entire success will be based on one or two features, no more. – Fred Lalonde, Hopper Co-Founder and CEO

Product features don’t all hold the same value in the eyes of customers. Some features create higher levels of customer loyalty and have a greater potential to impact customer satisfaction than others; these are the features product teams and startups need to focus on.

A Kano survey is one of the most effective tool to help identify these features.

Origins of the Kano Model

In the late 1970s, Japanese professor Noriaki Kano established that there are three main types of features required to develop a product that people want to use:

- Mandatory features: Mandatory features are the must-haves of a new product like a login form, or a user profile. These features are not perceived as adding value to the product, but they’re expected to be there regardless. They’re the features that your product needs.

- Linear features: Linear features are the core features of your product. They’re the two or three features your customers are really paying for; what differentiates your product on the market. These features are the main value you provide and what you write your marketing collateral around. This is where software companies typically compete.

- Exciter features: Exciter features are the features customers don’t expect, but that still add value. For example, an accounting tool may have automatic tax calculation, or it may include the local tax rules and exemptions. These small details can help delight the customer, create differentiation, and push the solution to the top of the product consideration set.

Out of the Kano model came both the Kano survey and the Kano analysis, a customer discovery questionnaire designed to help product teams and entrepreneurs categorize features by their perceived value in order to increase a product’s impact and fit with customers.

The Kano Questionnaire

A Kano survey can be done online, face to face, or with a paper questionnaire. A sample of 20 to 30 respondents in homogeneous segments can usually help teams determine 90% of all possible product requirements.

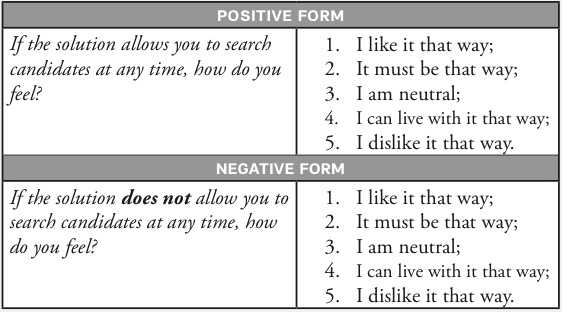

To run a Kano survey, you need to start by listing all the possible requirements. Then, for each requirement, the goal is to test both the positive and negative forms of the question, trying to capture a respondent’s perception of each feature.

Kano Survey Analysis

The question pairs allow you to evaluate your prospects or customers’ perception if certain product features were present or absent in the product.

For example, a prospect may like that your product has dark mode, but they may be able to live without it, making this feature more of a nice-to-have for them.

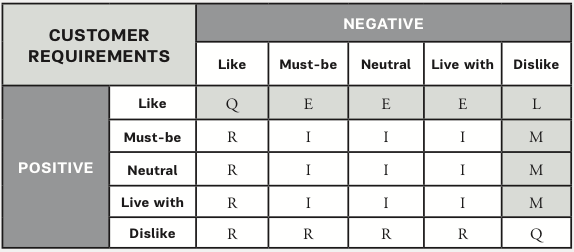

Collecting every respondent’s positive- and negative-form responses allows you to use a Kano evaluation table like the following to assess the perception of each feature or benefit:

Mandatory (M), linear (L) and exciter (E) features quickly stand out with the evaluation table. The Kano survey can also help highlight three more types of features:

- Indifferent (I): The customer is neither satisfied nor dissatisfied about whether the product has this feature.

- Reversed (R): The customer does not want this product feature. The prospect would prefer if it were not included.

- Questionable (Q): There is a contradiction in the customer’s answers to the question. This typically signifies that the question was either phrased incorrectly, or that there was a misunderstanding with the question.

How to Use the Insights From the Kano Model

Features can easily be re-prioritized using a Kano survey.

Mandatory features generally come first, followed by linear and exciter features. A compelling product ought to balance these three types with an emphasis on “killer features”; features that are so useful that the product becomes an essential part of the users’ workflow.

Depending on the responses collected, some Indifferent features might become good fits for the product if they fulfill the needs of your ideal customer profile. For that reason, it may be interesting to look at the correlations between the responses, and the prospects of your specific target profile. Which segment does your team want to please?

Remember that the categorization of your features will evolve over time. In the same way that free Wi-Fi in coffee shops was once an exciter, it has now become a key part of the coffee shop experience. Exciter features eventually become regular parts of the product once market expectations start changing.

It’s one of the reasons why a product that isn’t getting better over time doesn’t just stagnate, it regresses.

Is the Kano Survey Still Relevant in 2025?

Although the classification model of the Kano analysis, and the data generated by a Kano survey is still highly regarded in businesses, the complexity of running a research process using the Kano survey has turned off many teams.

A MaxDiff Survey can often generate a similar quality of insights in less time.

Although Kano surveys can be really effective, in my opinion, professor Kano’s greatest contribution is the feature classification model.

Moving forward, consider thinking about product features in terms of the main 5 categories of the model (Mandatory, Linear, Exciter, Indifferent, and Reverse). You’ll build a better product this way.

More on the Kano Survey

- Kano Model – How to delight your customers

- Your Product Needs These 3 Features

- 10 Signs You’re Targeting the Right Customers in B2B SaaS

Download the First 4 Chapters Free

Learn the major differences between B2B and B2C customer development, how to think about business ideas, and how to assess a venture’s risk in this 70-page sampler.

Working on a B2B Startup?

Learn B2B customer development with our free email course: