The fact is that when you’re talking to one customer it’s very easy to fall prey to their specific needs that may not be representative of the whole market. – Thor Muller, Get Satisfaction Co-Founder and Author

There’s an important bias built into the customer development processes of early stage companies.

Not only do you need to make sure you get your data from people that fit similar early adopter profiles, you also need to avoid being pigeonholed with early adopters.

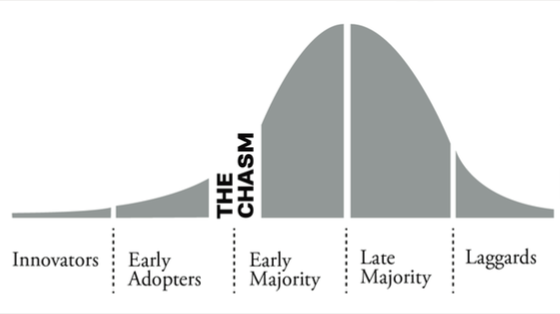

You’re interested in innovators and early adopters because they have a better grasp of new technology, but they represent a marginal group of customers in the market. You need to keep your eyes on the big(ger) prize: the early and late majorities.

Early adopters are just your starting point — your beachhead. You need to start with the lowest hanging fruits and keep in mind that it’s possible that the early adopters you meet have problems or needs that are years ahead of the mainstream market.

Unfortunately, the majority doesn’t always follow…

Be sure to remove edge cases from your analysis when conducting customer interviews to avoid building the wrong product.

Looking at the data you collect:

- Are some of your early adopters completely different from the majority?

- Are there early adopters that worked in completely different ways or had access to budgets or resources that others did not?

For our first series of problem interviews with my previous startup, HireVoice, we met with the HR director of a large gaming company. Of the HR specialists we met, he had the most budget and the most people and his department had much more influence over business practices than any of the other professionals we met.

The needs of his team clashed with the needs of every other early adopter we interviewed. We made the mistake of keeping the challenges of his team with the problems of our other early adopters and ended up building features and and working on ideas that were ahead of the curve for the vast majority of our prospects.

In the early stage, you need to seek out anomalies, note the differences and focus on the biggest wins for your business down the road. Avoid building a product for outliers.

More on Building Features

- How to Find the Core Features of Your Product Using a Kano Survey

- Your Product Needs These 3 Features

Download the First 4 Chapters Free

Learn the major differences between B2B and B2C customer development, how to think about business ideas, and how to assess a venture’s risk in this 70-page sampler.

Working on a B2B Startup?

Learn B2B customer development with our free email course: